Borrowers 504 – FAQ

The SBA 504 Loan Program is a low-cost, fixed-rate loan program intended for owner-occupied commercial/industrial property purchases and new construction. The Small Business Administration (SBA) loan program is offered through a partnership program between a Certified Development Company, like California Statewide CDC, and a participating private lender (most often a bank). California Statewide CDC partners with a wide range of leading lenders to make the SBA 504 Loan Program available to businesses throughout California.

An SBA 504 loan provides many advantages such as a low-down payment, low fixed interest rate and fully amortizing loan, leaving you with more capital available to expand your business. Not only are there tax advantages, but a real estate purchase with a fixed-rate loan results in lower overall expenditures, and predictable occupancy costs.

The 504 loan can help you buy, build, or renovate existing buildings including:

- Structural upgrades

- Physical expansion

- Landscaping

- Meeting new energy efficiency codes

- Upgrading to green technology

- Buying new equipment and heavy machinery and more.

With a low down payment, low fixed interest rate and fully amortizing loan, you will have more capital available to expand your business. Not only are there tax advantages, but a real estate purchase with a fixed-rate loan results in lower overall expenditures, and predictable occupancy costs. An SBA 504 loan is a powerful tool for small business owners. It offers:

- Up to 90% financing, to preserve working capital for business expansion

- Low monthly loan payments by utilizing 15- to 30-year amortization schedules from a First Mortgage Lender

- A variety of options for interest rates from a First Mortgage Lender

- The ability to finance the SBA fees as part of the loan, so more money stays in your pocket!

- Down payment as low as 10% preserves precious working capital

- SBA loan with below-market fixed interest rate reduces overall financing cost

- Fully amortizing SBA 504 (no balloon payment)

- Interest rate on first mortgage can be lower than conventional financing due to reduced risk; the overall blended rate is often lower than conventional financing

- Ability to include tenant improvement costs in project amount

The amount for a 504 loan can vary, but the limit is $5 million per project or $5.5 million for manufacturers or energy efficient projects. In fact, when used toward energy efficiency “green” projects, there is no limit on the number of projects business owners can finance and there is no limit on the first mortgage or the total project size.

The 504 loan is a combined loan between a conventional lender, a second mortgage from a Certified Development Company (CDC) such as California Statewide CDC and a 10 percent down payment that you provide. The CDC loan will fund up to 40 percent of the total loan and will have a 10, 20 or 25 year term limit below market interest rate.

Click here to see a sample project.

The good news? Most for-profit businesses are eligible for a 504 loan. These loans can be used toward a wide variety of projects with the following stipulations:

- Existing businesses must occupy at least 51% of the building

- Businesses must occupy at least 60% of the property for new construction

- Yourbusiness must have a tangible net worth of less than $15 million

- Your after-tax profit for the preceding two years can’t exceed $5 million

Click here to contact one of our experts to prequalify.

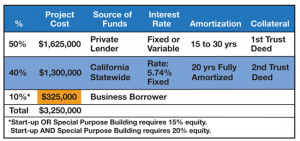

A 504 loan has three components as outlined below:

1st The participating lender/bank

The bank typically finances 50% of the total project cost through a first deed of trust loan.

2nd California Statewide CDC/us

We provide the second deed of trust financing for up to 40% of the total project cost with an affordable, long term fixed rate, fully amortizing SBA-backed loan.

3rd The Borrower/you

You will typically put down as little as 10% of the total project cost.

Example of a typical 504 project financing structure:

Over the years, California Statewide has forged great relationships with conventional bank lenders, credit unions and savings/loan associations. Based on your preferences, we can work with your current bank or we can help you find a lender. Once a bank lender is identified, your 504 loan is structured in three parts – 50% of the loan is provided by a conventional lender with a guarantee provided by the SBA, 40% of the loan is provided by the CDC/SBA and you, the borrower, provide a down payment of 10% (or 15% for hospitality projects and startup companies).

At the end of the day, you choose who you want to work with. There are many different lenders to choose from, each with their own set of specialties, rates and customer service approaches. If you have a preference, that’s great! If you need help navigating, and want some help deciding which way to turn, California Statewide CDC is here to help you. We’ll talk to you about your preferences and help you locate a bank that best fits your needs.

Click here to contact us for more information.

It’s possible to refinance a conventional loan. The eligibility requirements are the same as for the standard 504 loan, offering below-market, fixed interest rates amortized over 20 years for up to 90% of the appraised commercial property value. In fact, many business owners benefit by refinancing when they are faced with a pending balloon payment or have high interest mortgages. Although the process can seem a bit overwhelming, California Statewide CDC advisors are here to explain the process and help guide you through the different steps along the way. Click Here to find out more.

Prequalification takes less than 24 hours and gives you peace of mind when planning for your next project. Getting prequalified helps small business owners understand what kind of building they can afford. Although prequalification is not the same as a loan approval, it does give you leverage when planning for, and purchasing properties.

Click here to speak with a California Statewide CDC loan expert to prequalify and the subsequent steps needed to secure a 504 loan!

Each loan is unique, and as such, there’s no set timeframe for getting a loan. However, it may help to know the different steps it takes to get a loan approved, so you can understand at any point, where your loan is along the way.

Prequalification: 1 – 2 days

Applying for the loan – 2-3 weeks

This step varies based on how complex your project is. A California Statewide CDC rep will help you review the terms and help you get all your documents together. Your rep will then handle underwriting and coordinate terms with your bank before sending it off to the SBA to authorize.

Appraisal & Review

An appraisal and environmental review required by the SBA and your lending partner will be conducted and included in your loan package.

SBA Approval – 1 week

The loan package will be sent to the SBA and reviewed and approved/declined within 7 days.

Closing – 1 – 2 weeks

Once the SBA approves the loan, we will work with your lending partner to prepare the documents. We’ll send them to your escrow officer who will then schedule a time to sign the final documents and make your loan official!

Loan Funding & Bridge Loan – 1 – 2 months

After escrow closes, your loan enters the regular monthly debenture sale. After about a month, the debenture sale occurs and we’ll notify you of your below market loan rate. In the meantime, you may have a bridge loan. A Bridge loan is a short-term loan to fill a financial gap while waiting for your permanent financing to go through for your project. We’ll be by your side throughout the process to help guide you along the way.

Absolutely. You can have multiple 504 loans as long as you don’t exceed the SBA program limit of $5 million, or $5.5 million for “green” energy efficient projects. Small business owners find 504 loans preferable as they have lower interest rates and favorable repayment terms.

Click here to talk to a California Statewide CDC representative today to see if multiple 504 loans make sense for your small business.

Yes, you can pay off a 504 early without penalty once you reach the latter half of the loan’s term. For example, if you have a 20-year 504 loan, you can pay it off early following the 10thyear of the loan. If you intend to pay the loan off during the first half of the loan’s term, there is a prepayment penalty on the outstanding balance that begins at the debenture rate, which is typically less than 3% and declines by 10% annually, calculated by six-month intervals.

The 504 loan is assumable with SBA approval…and the good news is, there is NO prepayment penalty!

Click here to contact a California Statewide CDC representative to help you get started!