Sample Project

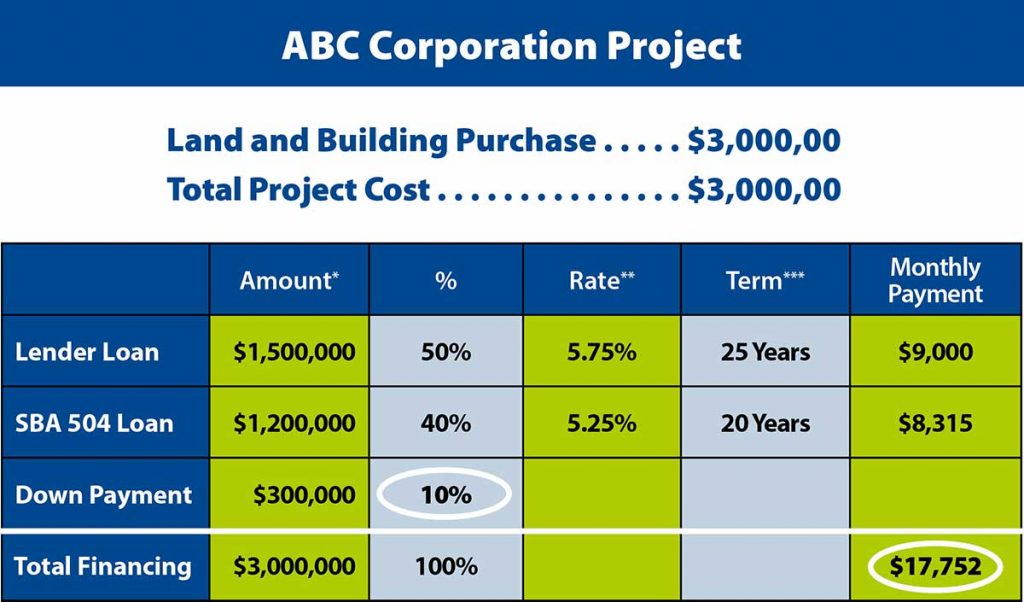

What a typical 504 project looks like

The SBA 504 Loan Program is a low cost, fixed rate loan program intended for owner-occupied commercial / industrial property purchases and new construction. This highly successful U.S. Small Business Administration (SBA) loan program is offered through a partnership program between a Certified Development Company (CDC) and a participating private lender (most often a bank). California Statewide CDC partners with a wide range of leading lenders to make the SBA 504 Loan Program available to businesses throughout California.

The participating lender (bank) typically finances 50% of the total project cost through a first deed of trust loan. California Statewide CDC provides second deed of trust financing for up to 40% of the total project cost with an affordable, long term fixed rate, fully amortizing SBA-backed loan. The borrower typically puts down as little as 10% of the total project cost.

- Loan amounts and down payment vary with project type and credit quality. 504 loan limit is $5.0 million per borrower for non-manufacturing companies ($5.5 million for manufacturers; limit for manufacturers is on a per project basis); projects of $14.0+ million possible, depending on the bank.

- Bank rates vary with lender. 504 rate is set at funding (approximately 60-90 days after escrow closing, or after completion of improvements, if applicable) at the 10-year U.S. Treasury note plus market spread and ongoing SBA fees.

- Bank loan has minimum 10-year term and 15- to 30-year amortization. The 504 loan is a 10, 20 or 25-year fully amortizing loan and payments are estimated.

- Both loans use the same appraisal and environmental due diligence report.

- Loan fees for the bank range from up to 1.5% of the bank's loan (first mortgage). 504 fees (second mortgage) are approximately 2.65% of the loan amount as regulated by the statute, plus a $2,500 attorney closing fee which are financed with the loan.

- The small business and its affiliates combined must have a net worth of less than $15 million and an average after-tax profit for the last two years of less than $5 million.

- Small business must meet conventional credit underwriting criteria.

- California Statewide CDC can pre-qualify customers within 24-48 hours.